Federal unemployment withholding calculator

The W-4 form that you. Calculated amounts determine the contribution amounts to be paid or withheld for reporting to us.

Futa 2022 Futa Taxes And How To Calculate Them Nav

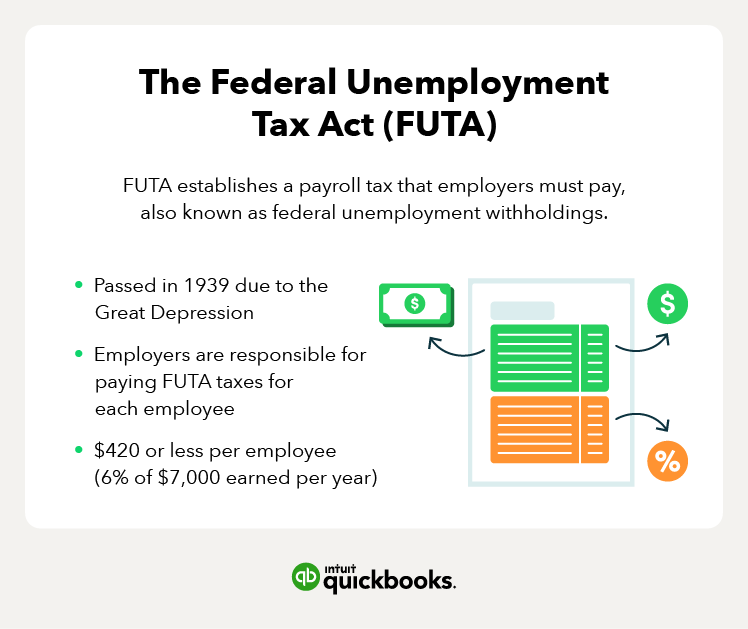

The FUTA tax is 6 0060 on the first 7000 of income for each employee.

. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. If youve paid the state unemployment taxes you can take a credit of up to 54. Both you and your employee will be taxed 62 up to 788640 each with the current wage base.

The 2017 federal unemployment tax is 6 of the first 7000 you pay in wages to an employee. State Unemployment Insurance Tax-- --. South Carolina Department of Revenue.

This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income. Supports hourly salary income and multiple pay frequencies. Take these steps to fill out your new W-4.

Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. Feeling good about your numbers. This Estimator is integrated with a W-4 Form.

You must pay federal unemployment tax based on employee wages or salaries. âStandard paymentsâ and âbonusesâ are both taxable. Standard payments Weekly payments.

Amount Equivalent to 30x the Federal Minimum Wage of 725 based on your pay frequency Weekly or less 21750. Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Columbia SC 29214- 0400. The maximum an employee will pay in 2022 is 911400. Current taxable wage limits are available on Rates and.

This free easy to use payroll calculator will calculate your take home pay. The Tax Withholding Estimator on IRSgov can help determine if taxpayers need to adjust their withholding consider additional tax payments or submit a new Form W-4 to their. Every other week 43500.

Rate limits used are an estimate only. Taxpayers who withhold 15000 or more per quarter or who make 24 or more withholding. Youll need your most recent pay stubs and income tax return.

For 2020 if you earned under 150k the first 10200 in Unemployment is tax-free. SmartAssets Mississippi paycheck calculator shows your hourly and salary income after federal state and local taxes. 2x per month 47125.

Your employees FICA contributions should be deducted from their wages.

Financial Accounting Payroll In 2022 Financial Accounting Accounting Classes Payroll

What Percentage Of A Paycheck Goes To Taxes Paycheck Tax Tax Services

Futa Tax Overview How It Works How To Calculate

Federal Unemployment Tax Act Futa Rate For 2022 Pay Stubs Now

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Department Of The Treasury Internal Revenue Service Publication 15 Cat No 10000w Circular E Employer S Tax G Tax Guide Internal Revenue Service Employment

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners

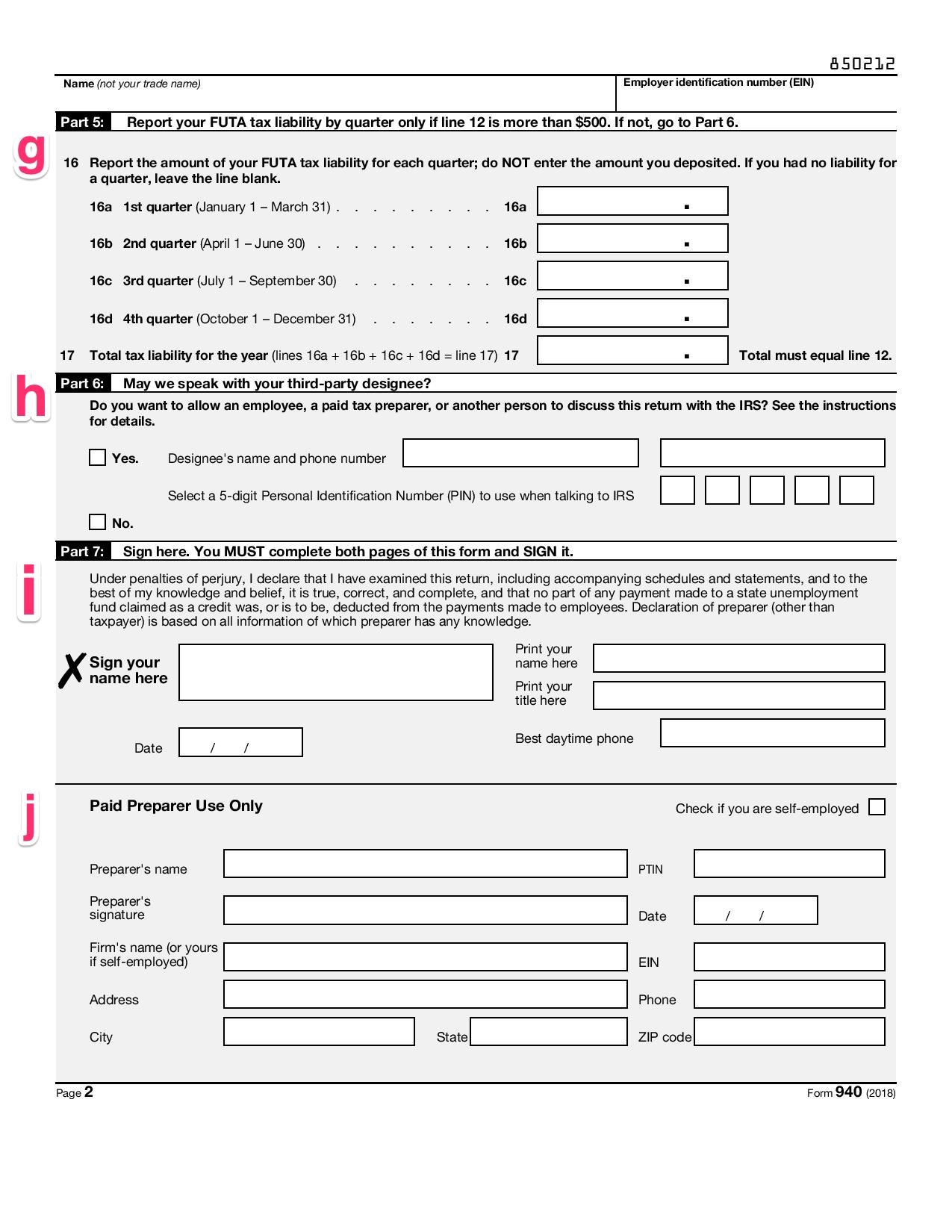

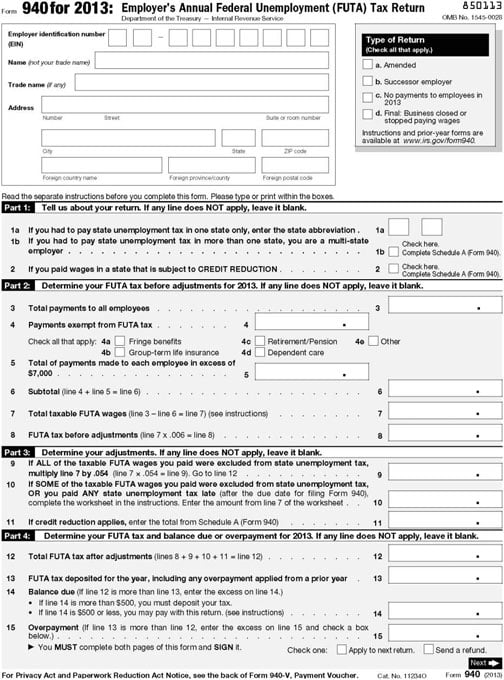

How To Fill Out Form 940 For Federal Unemployment Taxes

Accountants Are In The Past Managers Are In The Present And Leaders Are In The Future Accounting Services Accounting And Finance Financial Management

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Templates

How To Calculate Unemployment Tax Futa Dummies

How To Fill Out Irs Form 940 Futa Tax Return Youtube

Federal Unemployment Tax Act Calculation Futa Payroll Tax Calculations Futa Youtube